|

|

|

|

OR

Here's how it all works

Add to bag

Added the styles you love to your bag? Perfect. Next, select ‘Klarna’ when checking out.

Select Pay with Klarna

Goodbye shopping stress. Simply enter your details and you’ll know instantly if you’re approved.

Quick confirmation

Not sure when to pay, or if your order's confirmed? Don’t worry, Klarna will email you shortly.

What do I need?

1. A UK bank account

2. To be 18 years of age or over

3. A UK residential address

Klarna is a Swedish payment service provider that takes end-to-end responsibility for your payment. Did you know that they provide smooth payments to more than 200,000 online stores & that 85 million consumers worldwide have trusted Klarna to securely handle their payments? Yep.

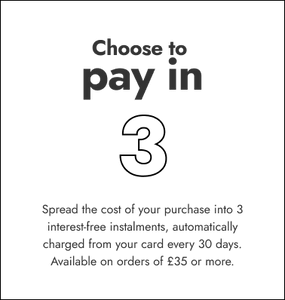

'Pay in 3 interest-free instalments’ allows you to spread the cost of your purchase over 3 equal payments. Please bear in mind that the payment for each instalment will be automatically collected from the debit or credit card you entered at checkout. Your first instalment will be collected when your order is confirmed and instalments 2 and 3 are scheduled 30 and 60 days later. A quick way to monitor your payments’ schedule? In the Klarna app.

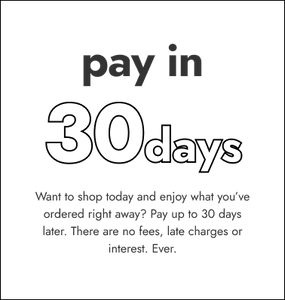

Good question. Once your order is confirmed, Klarna will email you with payment instructions within two days. You’ll then have 30 days to try your order on, decide what you’re keeping & pay when you’re happy. Complete the payment online, at your convenience, with no extra cost. You can pay via credit or debit card in the Klarna app or by logging in to Klarna

To use ‘Pay later in 30 days’ or 'pay in 3 interest-free instalments’, you must be at least 18. While both payment options are widely promoted, ‘Pay later in 30 days’ and 'pay in 3 interest-free instalments’ are subject to your financial circumstances. It’s worth noting that Klarna’s assessment will not affect your credit rating. Borrowing beyond your means could seriously affect your financial status though so please ensure you can afford to make your repayments on time by their due date.

If you want to purchase with Klarna you’ll need to provide your name, address and email address. For some orders, you may need to supply your mobile number or date of birth, too. All information will be sent to your email address, including payment reminders and links to your online statements, so it’s (very) important that you give us the correct details.

If you choose the option 'pay in 3 interest-free instalments’, Klarna will automatically attempt to collect the payment for your 'pay in 3 interest-free instalments’ purchase from the debit or credit card you entered at checkout. If we are unable to collect your payment on the scheduled due date, Klarna will make one further attempt to automatically collect payment two days later. However, should this last payment attempt fail, Klarna will send you a statement for the full outstanding order amount which will become payable 15 days later. Klarna will notify you when a payment is due two days in advance of attempting to collect your payment, plus, you can always monitor the due date in Klarna app at your convenience.

If you choose the option ‘Pay in 30 days’, payment is due 30 days after the item is shipped. To help you pay on time, we’ll alert you two days before payment is due – you'll receive a push notification from the Klarna app or email reminders to pay – and, if very late, we’ll send you a text or letter, too.

Your credit score will not be impacted by using Klarna’s 'pay in 3 interest-free instalments’ or ‘Pay later in 30 days’ products, even if you have failed to pay on time. If you fail to pay on time, you will be in default, and may be unable to use Klarna’s services in the future. Failure to make payment on time could result in your debt being passed to a debt collection agency, so please spend responsibly.

Klarna may run so-called unrecorded enquiries (or soft credit searches) that do not affect credit scoring and are only visible to you and Klarna, but not visible to other lenders. Neither Klarna nor New Look runs credit searches against you that could impact your credit rating.

Yep. Just go to the Klarna app or log in to Klarna.com/uk to make a payment.

Refunds will be issued back to the debit or credit card that was originally entered at checkout.

Although ‘Pay later in 3 interest-free instalments’ and ‘Pay later in 30 days’ are widely promoted, it is not always universally available. The 'pay in 3 interest-free instalments’ and ‘Pay later in 30 days’ payment options are automatically generated by algorithms that are dependent upon several factors including your address details, cardholder details, amount of order, the online store, previous order history and item availability.

For extra support, please visit the Klarna app or Klarna’s Customer Service page for a full list of FAQs, live chat and telephone options.

Klarna is available on our website, our mobile app, and you can find it in many New Look stores, too.

Please spend responsibly. New Look Retailers Limited acts as an introducer and not a lender of unregulated credit products provided by Klarna Bank AB (publ). Klarna is only available to permanent UK residents aged 18+, subject to status, terms and conditions apply. Payments will be made directly to Klarna and must be repaid in line with the relevant product terms. Pay Later products (Pay in 3 instalments and Pay in 30 days) are not regulated credit agreements and Klarna is not subject to supervision by the Financial Conduct Authority when it offers these products. Before you can use a Pay Later product, Klarna will perform a soft credit check - this initial search will not affect your credit rating and the check is not visible to other lenders. Borrowing beyond your means could seriously affect your financial status, ensure you can afford to make your repayments on time by their due date.

Check out klarna.com to find out more

Terms and conditions

In cooperation with Klarna Bank AB (publ), Sveavägen 46, 111 34 Stockholm, Sweden, we offer you the following payment options.

Payment is to be made to Klarna:

- Pay in 3 Interest free instalments.

- Financing: With the financing service from Klarna you can pay your purchase in flexible or fixed monthly instalments according to the conditions stated in the checkout. The instalment payment is due at the end of each month after submission of a separate monthly invoice by Klarna. Further information regarding Slice It including terms and conditions and Standard European Consumer Credit Information you can find here.

Further information and Klarna’s user terms you can find here. General information on Klarna you can find here. Your personal data is handled in accordance with applicable data protection law and in accordance with the information in Klarna's privacy statement.

Klarna Privacy Policy

In order to be able to offer you Klarna’s payment options, we will pass to Klarna certain aspects of your personal information, such as contact and order details, in order for Klarna to assess whether you qualify for their payment options and to tailor the payment options for you.

General information on Klarna can be found here. Your personal data is handled in accordance with applicable data protection law and in accordance with the information in Klarna’s privacy policy.

Risk Warning

*If you do not make your full monthly payment, the interest free arrangement will cease and you'll be required to pay interest on all future payments at 18.9% APR representative.

Please spend responsibly. Borrowing more than you can afford could seriously affect your financial status. Make sure you can afford your monthly repayments on time.

Late or missing representative payments may have serious consequences for you and cause you serious money problems.

- Choosing a selection results in a full page refresh.